Promote your intangible assets

Over the last decade, Western economies have become massively intangible. Recent studies estimate annual investment in intangibles in the United States is between USD 800 billion and USD 1 trillion. Current intangible assets in French companies alone represent around 3 trillion Euros, but only 15% are known and accounted for, and this trend can be seen in major financial markets throughout the world.

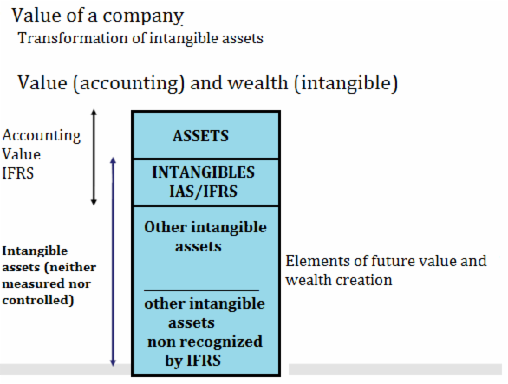

Consequently, the value of intangible assets has increased significantly under IAS-IFRS standards compared to traditional accounting valuation, thus the necessity to measure processes and the intangible value they create. IAS-IFRS standards are driving this movement by recognizing a number of intangible assets and the need to measure them accurately.

Valorization is now possible for non-recurrent high value-added processes (specifications, models, job sheets, technical data sheets, certification procedures, technical manuals, etc.), which are components of the industrial process, from the design phase to the finished product.

CLUSTRIA offers to codify around 80 product management processes, which enables a company to measure intangible assets automatically and integrates these into the balance sheet, which allows for an accurate assessment of value according to IFRS and increases the possibilities for financial leverage to accompany future development. The system leads to a better understanding of the true value created by an enterprise.

Valorization of intangible assets is a module offered by CLUSTRIA and designed for professionals in the finance and banking sectors seeking to put in place a new system to account for this value.

CLUSTRIA advocates the establishment of banking compensation systems on a regional level, close to the sources of value creation.